Property Taxes FAQ

Who Collects Taxes on My Property?

TrailMark Metro District (TMMD) is a quasi-governmental body. TMMD is one of many entities that assess property taxes on TrailMark homes.

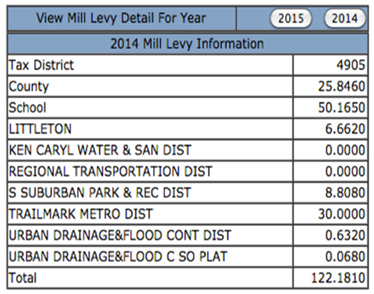

The chart below shows all of the entities who imposed a mill levy (tax) on TrailMark homes in 2014.

How is the Actual Amount of Property Taxes I Owe Determined?

The annual property tax a homeowner owes is based on two factors:

1) the property’s “Assessed Valuation” (as determined by the Jefferson County Assessor)

2) the total number of mills assessed by all taxing entities (“mill levy”)

Annual Property Tax = Property Assessed Valuation divided by 1,000 then multiplied by the total mill assessment

What Does “1 mill” Mean to Me, in Terms of Dollars?

One mill is equal to 1/1000 of a dollar of the property’s assessed value as determined by Jefferson County.

1 Mill = Property Assessed Valuation divided by 1,000

The actual cost of a mill will vary from property to property and from year to year because Assessed Valuations vary from property to property and from year to year.

How Much Revenue Does TMMD Collect from its Mill Levy?

The annual revenue collected by TMMD each year depends upon 2 factors:

1) The collective Assessed Valuation of the TrailMark neighborhood (the assessed value of all properties within TrailMark as determined by Jefferson County Assessor)

2) The mill levy set by TMMD

What Does TMMD do with the Taxes It Collects?

The TrailMark Metro District levies mills (taxes) to generate revenue to pay for the following:

· Outstanding general bond obligations which were used to finance the infrastructure construction costs of the neighborhood (Debt Fund)

· General Operating Expenses of the Metro District (General Fund)

DEBT FUND:

The Debt Fund collects taxes earmarked for the repayment of bonds. The current bonds TMMD is repaying were taken out when TrailMark was first established; the developer used the revenue from these bonds for purposes of building TrailMark’s infrastructure.

TMMD’s current Debt Fund mill levy is set below what is necessary to meet the bond obligations. Thus, TMMD is currently under-collecting revenue necessary for bond repayment. For 2015, the TMMD assessed a Debt Fund tax of 20 mills which would generate an estimated $482,074 in revenue. The 2015 Debt Obligation is $730,646. The TMMD is drawing from cash reserves (General Fund) to supplement the approximate $248,572 shortfall in Debt Fund revenue. To have fully funded the Debt Fund through taxes, and avoid use of reserves in the General Fund, approximately 10 additional mills would have been assessed on each home in the neighborhood. (See Bonds/Debt Fund Mills illustration below).

GENERAL FUND:

The General Fund collects taxes used for all other general TMMD operations including expenses such as management, legal compliance, and maintenance of ponds and fences. The 2015 operations budget for TMMD is $218,565.

Are There Limits to TMMD’s Taxing Authority?

GENERAL FUND:

TMMD CANNOT impose a tax (mill) which generates more than $500,000 revenue per year for Operations (General Fund). In 2015, this revenue limit effectively caps the general operations mill at 20.73 Click here for a detailed illustration of TMMD’s taxing limitations.

DEBT FUND:

TMMD can impose a tax (mill) up to 66.027 in order to service the current outstanding debt obligations (Debt Fund). In 2015, TMMD could have set the mills for debt fund at 30.31. Click here for a detailed illustration of TMMD’s taxing limitations.

The Service Plan limits the amount of debt TMMD can incur to 8.5 million. To date, TMMD has used $8,333,977 of this debt authorization. TMMD CANNOT incur debt (take out new bonds) in excess of 8.5 million without voter approval (TABOR vote) and an amendment to the Service Plan. A TABOR vote is conducted during an official election. Every registered voter in TrailMark receiving an election ballot would have the opportunity to vote whether TMMD should incur more debt.

Illustrations of TMMD’s Taxing Limitations

In an effort to better answer the question “What is the highest TMMD can set the mills without first obtaining voter approval?” the following illustration has been prepared:

GENERAL/OPERATIONS FUND MILLS ILLUSTRATION – 2015 figures

Based on TMMD’s 2015 Mill Certification, 30 mills = $723,111 in revenue to TMMD.

1 mill = $24,103.70 in revenue to TMMD in 2015.

TMMD cannot collect more than $500,000/year for the General Operating Fund.

If 1 mill = $24,103.70 in 2015, and TMMD cannot collect more than $500,000/year for operations, TMMD could have collected a maximum of approximately 20.73 mills in 2015 for operations.

DEBT/BONDS FUND MILLS ILLUSTRATION – 2015 figures

TMMD can impose whatever mill is necessary to pay the bonds/debt up to 66.027.

Based on 2015 Budget, $730,646 in debt is due/payable in 2015.

If 1 mil = $24,103.70 in 2015 and TMMD has $730,646 in bond payments for 2015, TMMD could have collected up to 30.31 mills for the debt fund* in 2015.

*Monies collected for the debt fund must be applied to the existing debt service.

COMBINED TOTALS FOR DEBT FUND & GENERAL FUND LIMITS:

Based on the above illustrations, the combined maximum mill levy TMMD could have set in 2015 was 51.04 (20.73 General Fund + 30.31 Debt Fund)